Texas law allows for handwritten wills. A handwritten will can suffice if it is well-written.

Most handwritten or holographic wills are not well-written. They often include ambiguous and conflicting language, omit assets or intended beneficiaries, and are executed at a time when the decedent may not have the requisite mental capacity to execute a will.

This is why disputes are common when it comes to holographic wills. The Estate of Silverman, No. 14-18-00256-CV (Tex. App.–Houston [14th Dist.] 2019) case is an example of this. It involves a handwritten will that names an executor but does little else. The litigation addresses whether this type of writing can count as a valid will.

Facts & Procedural History

The decedent was a forensic psychiatrist. Two years prior to his death, the decedent signed a letter saying that his office manager was to be the executor in the event of his death.

After the decedent died, the office manager filed an application for probate based on the letter being a holographic will. The decedent’s siblings and mother contested the application.

The probate court did not admit the holographic will and found that the decedent died intestate. The office manager appealed, which brings us to the present court case.

What is a Will?

A will, also known as a last will and testament, is a legal document that expresses a person’s final wishes regarding the distribution of their assets and the management of their affairs after their death. It allows individuals to outline how they want their property, belongings, and other assets to be distributed among their chosen beneficiaries.

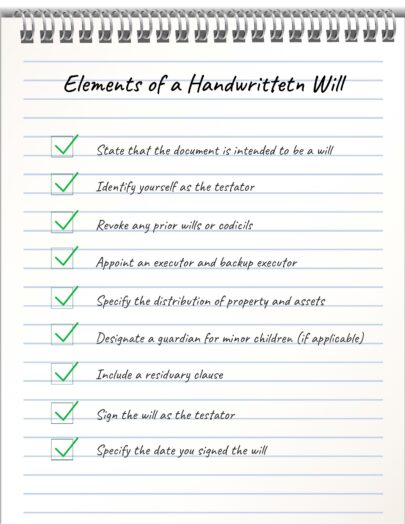

A will typically includes several key elements:

- Appointment of an executor: The testator (the person making the will) appoints an executor, who is responsible for carrying out the instructions outlined in the will, including distributing assets and settling debts.

- Asset distribution: The will specifies how the testator’s assets, such as real estate, money, investments, personal belongings, and other property, should be distributed among beneficiaries or charitable organizations.

- Guardian designation: If the testator has minor children, the will may designate a guardian to take care of them in the event of the testator’s death.

- Specific bequests: The testator can make specific bequests, outlining particular items or sums of money to be given to specific individuals or organizations.

- Residual clause: The will often includes a residual clause that addresses any remaining assets not covered by specific bequests, ensuring they are distributed according to the testator’s overall wishes.

- Signatures and witnesses: A will typically requires the testator’s signature, as well as the signatures of witnesses who can attest to the testator’s soundness of mind and the voluntary nature of the will.

Creating a valid will ensures that an individual’s wishes are respected and can help minimize potential conflicts and confusion among surviving family members.

Handwritten or Holographic Wills in Texas

Texas law allows for holographic wills. Holographic wills are those that are entirely in the decedent’s handwriting and that don’t follow all of the formalities required for wills under Texas law.

Holographic wills are often used given their flexibility and informality compared to formal wills. While formal wills typically require witnesses and formalities, holographic wills allow for a more relaxed approach. Holographic wills may be valid even without witnesses.

With respect to holographic wills, the appeals court notes that “courts often state that the writing must operate to transfer, convey, or dispose of the testator’s property upon death.” This is why the probate court did not admit the holographic will to probate. The probate court concluded that the letter appointed an executrix, but it did not dispose of the decedent’s property and since it did not dispose of property, it was not a valid holographic will.

On appeal, the appeals court concluded that the letter appointed an executrix. It also concluded that it was not clear whether the letter disposed of the decedent’s property. This combination of appointing an executrix and an ambiguity as to the disposition of property was sufficient.

Examples of Holographic Wills

Holographic wills can take various forms, depending on the medium used by the testator to express their intentions. Here are some examples of the types of writings that have been found to be holographic wills:

- Handwritten letter: A formal or informal letter written by the testator that clearly states their testamentary wishes, identifies specific beneficiaries and includes the testator’s signature and date.

- Notebook or journal entries: Testator’s handwritten entries in a notebook or journal that outline their desires regarding the distribution of assets, the appointment of executors, and any other provisions they wish to include in their will.

- Note on any piece of paper: A handwritten note, regardless of the size or material, such as a napkin, a scrap of paper, or the back of an envelope, that contains the essential elements of a will, including the testator’s wishes, beneficiary designations, and their signature.

- Personal diary: Entries in the testator’s personal diary that clearly indicate their testamentary intentions, including the distribution of assets and property.

Even a note written on a wall can count as a holographic will.

Common Problems With Holographic Wills

While a holographic will is easier to prepare than a formal will, they are also easier to challenge. Holographic wills frequently trigger disputes involving:

- Ambiguity and Interpretation: Holographic wills may lack clarity or precision in their language or instructions. Handwritten documents can sometimes be open to interpretation or contain ambiguities, leading to disputes among beneficiaries or uncertainty in understanding the testator’s true intentions.

- Incomplete or Inconsistent Content: The informal nature of holographic wills can result in incomplete or inconsistent provisions. The testator may overlook important aspects, fail to address all their assets, or unintentionally create conflicting instructions. This can lead to confusion during the probate process and potentially result in litigation.

- Difficulty in Proving Authenticity: Establishing the authenticity of a holographic will can be challenging, especially if the testator is no longer alive to confirm their intent. The burden of proof may fall on the executor or beneficiaries to demonstrate that the handwriting, signature, and content of the will are genuinely that of the testator.

The Takeaway

While a handwritten will is not advisable, particularly since the cost of having a will drawn by a licensed attorney in Texas is negligible, this case highlights the basic requirements of a holographic will in Texas. At a minimum, the will should identify the executor and dispose of the decedent’s property. Anything less is likely to result in a will contest or prolonged probate administration.

Do you need help with a probate matter in Houston or the surrounding area? We are Houston probate attorneys. We help clients navigate the probate process. Call today for a free confidential consultation, 281-219-9090.

Our Houston Probate Attorneys provide a full range of probate services to our clients, including helping with disputes involving holographic wills. Affordable rates, fixed fees, and payment plans are available. We provide step-by-step instructions, guidance, checklists, and more for completing the probate process. We have years of combined experience we can use to support and guide you with probate and estate matters. Call us today for a FREE attorney consultation.

Disclaimer

The content of this website is for informational purposes only and should not be construed as legal advice. The information presented may not apply to your situation and should not be acted upon without consulting a qualified probate attorney. We encourage you to seek the advice of a competent attorney with any legal questions you may have.